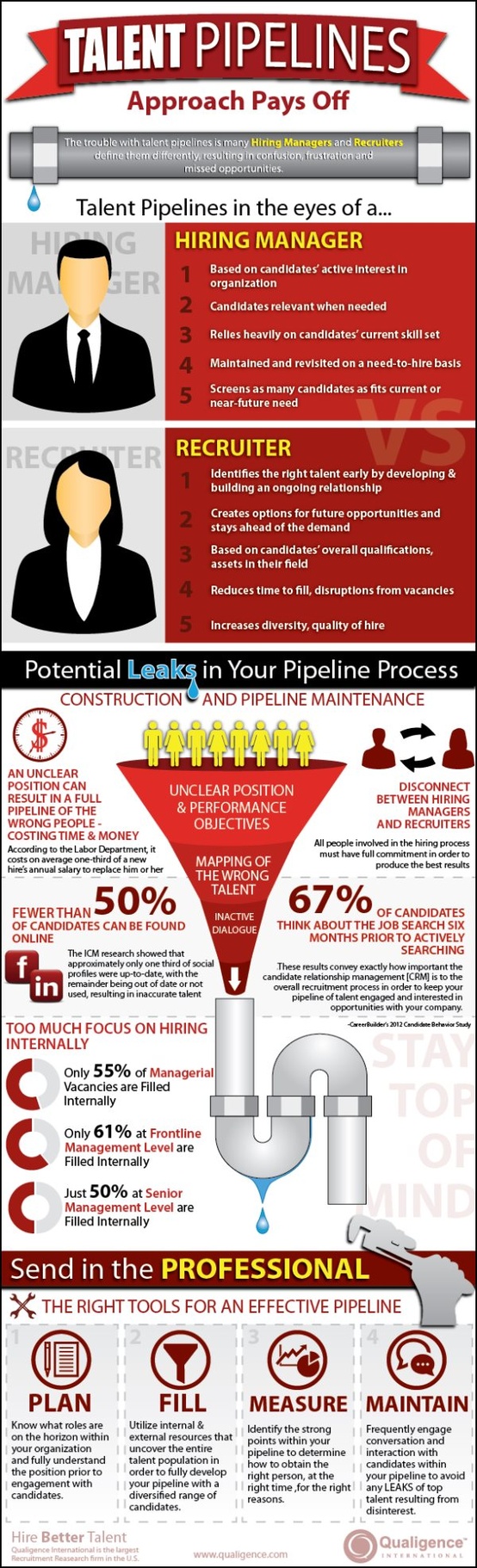

Sometimes it’s hard to define a “Talent Pipeline” to the many constituents involved in the hiring process.

Here’s a great Infographic from Qualigence that defines the process well.

Recruiting & HR Tech Founder & Entrepreneur

Sometimes it’s hard to define a “Talent Pipeline” to the many constituents involved in the hiring process.

Here’s a great Infographic from Qualigence that defines the process well.

The once 800 pound Gorilla in the Internet Job Search Market, Monster.com, is slowly coming to the end of it’s life.

The once 800 pound Gorilla in the Internet Job Search Market, Monster.com, is slowly coming to the end of it’s life.

On December 4th, 2013,Monster started laying off hundreds of employees, and abandoning some international markets.

As a pioneer in the Internet Recruting and Internet Job Search industry, I’ve always lived and worked under the “Monster Cloud”. Monster has always been a big force in the industry, until the last 5 years.

Personally, I think founders bring a lot of focus and vision to a company. When they leave, a lot of that time, their vision leaves with them.

Think of Apple without Steve Jobs… (the thought of the Skully years… comes to mind.. well now too.)

Microsoft without Bill Gates…

Oracle without Larry Ellison, or

Starbucks without Howard Schultz?

Amazon without Jeff Bezos?

LinkedIn without Reid Hoffman

and of course, Facebook without Mark Zuckerberg.

That’s how I think of Monster without Jeff Taylor.

Taylor orchestrated the early years of Monster. He helped define Monster, and Internet Recruitment. He “crossed-the chasm” with Monster and brought Internet Recruiting into its existence.

The vision grew, and then was backed by bigger money, went public and continued to grow and scale up. The disruption of the “Print Classifieds” and transformation to “Internet Recruiting” was based on the single premise of creating a central portal to post your resume where employers could find you, and you could find employers with job openings.

Once the disruption was complete, the bean counters and Wall Street took over. Corporate money came in and innovation went out. Jeff left. That was August of 2005, and Monster has been slowly dying from that day forward.

Innovation was no longer a part of the corporate culture.

Instead, innovation became a line on the Balance Sheet, outsourced or purchased.

Without a vision, Market penetration and revenue became the game.

Monster went on to try to innovate through “acquisition”, which is a very difficult when it comes to your core company vision and technology.

That lead to several highly funded Venture startups whose sole exist strategy was “buyout-by -Monster” and other strange acquisitions.

* Tickle, an early social media site, $100 million, by Rick Marini, now Founder and CEO of Highly-funded, Branchout

* HotJobs, purchased from Yahoo, $245 Million, (essentially job seeker and client acquisition purchase)

* FlipDog, technology acquisition

* AffintyLabs, Social Networking platform, $61 Million

* Trovix, a Search Technology company, purchased in 2008, for $72.5 Million.

Some of the acquisitions made perfect sense.

Integrating these technologies into the Monster Brand, again, without a vision and real leadership, became almost impossible. Trovix, for example had great semantic search technology, that Monster purchaed in 2008. It took over 4 years for Monster to integrate the semantic technology they purchased into their core product. Monster’s 6Sense‚Ñ¢, was finally launched in 2012.

By then, Monster executives were hanging out on Long Island going over the “Next Deal”, while a little company in Mountain View, with an idea, passion, a great set of founders, and access to money, was working away at the next disruption… LinkedIn.com.

While I have only met Jeff one time, from what I know about the early days, Jeff was definitely a character. You might have loved him or hated him, but he did have a presence and he built a highly successful company out of that energy.

Monster may not have always been out front on a lot of technologies, but they have adopted and continued to use their big international presence to continue to push the envelope of Internet Recruiting.

Unfortunately, I think a lot of people in New York are learning that Innovation isn’t something that can be purchased.

Innovation created and killed Monster, nothing else.

Just my $.02.

What do you think?

Leave a comment below, or use the buttons below to “Like” or “share” this post on Facebook, LinkedIn, Twitter, or Google+.

With the recent announcement of the long-awaited “Facebook Job App”, and having read some pretty negative reviews, I started wondering what kind of impact will Facebook really have in the “recruiting industry”.

First off, everyone wonders…

“Will this kill LinkedIn?”

Not at all.

I think LinkedIn will benefit from the competition.

In the recruiting world it sometimes takes a 5-10 years for technology to get adopted. That’s not bad, it’s just what it is.

“Social Recruiting” is still very new to corporations as a recruiting tool.

With Facebook getting into the market, more money and resources will be spent by HR and recruiting departments to “figure out” how to use the systems.

Because the Facebook application is pretty much terrible, LinkedIn is going to get a bigger share of the growing market. The market will grow, and only one provider has a viable product.

Facebook will cause some problems for the traditional job boards though.

Monster and CareerBuilder are not going to be happy about this though.

Facebook will EAT Monster.

My guess is that this is a “shot-across-the-bow” for Monster.

The Facebook app isn’t ready for prime-time, and the problems don’t see to be engineering… They seem to be systemic. Luckily for Monster.

If Facebook really wanted to be in the market, why would they come up with such a terrible application? Why would you create 4 tabs and not integrate the results? Even if it’s a test, this could have been done better. Does Facebook really have the will?

Right now they have 1.7 million jobs.

Indeed has over 7 million and SimplyHired 5 million.

(Maybe Facebook should buy SimplyHired! Heck, they’re only down the street!)

My guess that Monster was grabbing at straws to be a “job posting partner”. With the failure of BeKnown, their social application where “unemployed people can hang out and chat with other mutually depressed unemployed people”, they didn’t have much to talk about on earnings calls.

In the short-term, the Facebook Job App, might keep the Monster name around, but it’s really just duct-tape.

Will Monster get access to job seekers? Probably. But, will they own the job seeker? No more!

(Think Steve Jobs, with the music industry. Apple creates a new distribution system and they own the client… game over.)

The big problem: Monster and Facebook share the same demographics.

Monster and CareerBuilder have to face is they share the same demographics of the Facebook members who are most likely willing to share professional profile information on a social platform, Gen Y.

Gen Y and other younger generations are the life blood of monster. Monster and CareerBuilder sell more job postings and resume database seats to companies with high volume staffing requirements; part-time, entry-level, and middle to lower management positions.

Unfortunately, for Monster and CareerBuilder, this is probably the most probable market for Facebook.

Gen Y has been using Facebook as part of their life for many years now. Meanwhile, they aren’t on LinkedIn.

LinkedIn is for building your career, not your average conversation for a 20-30 year old.

Gen Y might not care about including professional information on their profile, whereas Gen X and older generations hardly cross the social / professional online barrier.

As a result, you might see Facebook being adopted by Gen Y, while Gen X sticks with LinkedIn. Two different markets, two different platforms.

Just prepare for a new low of about 25% for the Monster stock in the next 12-24 months…

Just my thoughts.

Jonathan Duarte

Jobvite, an applicant tracking software firm that helps employers post jobs and track candidates during the hiring process, recently released it’s annual “Social Job Seeker Survey”.

While I normally enjoy reading through this and other Recruiting and Job Search Surveys, especially the annual “Source of Hire Report” from Gerry and Mark at CareerXRoads, I don’t think this survey should be considered any more valid than most recruiters empirical evidence regarding social recruiting.

This one is just… I don’t know… just off the mark a little bit.

Before we get into some of the details, I first must say that I do think that Jobvite’s Social Recruiting Surveys continually seem to be dead on, so I don’t know why this one is weird, but here are my thoughts.

First off, if the poll originally had 2,108 respondents, but only 1,266 (60%) were part of the American Workforce, doesn’t that mean that the method of sampling was way off anyways? What method was used to delete the 40% of respondents? And, if these candidates weren’t located in the US, was using a “online opt-in panels” a very good source of determining the accuracy of the average American Workforce?

Second, on page 9, the results say that 83% of respondents (who met the survey criteria) had a Facebook account. That sounds fine. But, the results show that 46% of the “US Workforce Sample” had a Twitter Account and only 41% had a LinkedIn account. Even considering that LinkedIn is more of a professional, versus part-time and retail industry network, I still can’t believe that this is accurate. More of the US Workforce is using Twitter than LinkedIn… Really?

This might be the case, if Twitter is predominately being used for gossip, news, and entertainment… heck if Justin Bieber were headlining LinkedIn, I’m sure the stats on LinkedIn might be a little different, too.

Here’s a stat that pretty much made me doubt the entire survey process.

On page 12, the results show that respondents stated that 26% of respondents stated that Newspapers were “directly responsible” for finding their current/ most recent job, while Referrals were only 5% higher at 31%.

Really???

Maybe there is problem with the way the question was asked, or how users considered the question, but come on… Newspapers directly responsible for 26% of current jobs… I don’t think so.

If that stat was even remotely valid I’d start buying shared in all the trashed newspaper stocks. Has anyone seen what has happened to newspaper classified revenue numbers lately… reality is proving just the opposite of the study.

If that wasn’t enough, on the very next page, the study reveals that 41% of respondents found their “Favorite/Best Job from a Friend or Family”…

Empirically, and from other studies such as the Annual Source of Hire studies, and even other JobVite studies, many of us in the indusry would agree that this is probably pretty accurate.

So, what’s the difference between this question and result, versus the last question and result? Sounds more like a problem with the polling. Is it how the question was asked? Who knows. I’m no statistical analysis expert, but this doesn’t seem to make sense.

Finally, and this was the final “statistic” that made me want to write this blog post…

On page 14, “Who are the job seekers on Facebook?” the study shows that the largest poll of respondents had an annual income of over $100,000 (25%), while in the next result stated that the largest pool of respondents (34%), state that their “Education” level was “Some College”.

WHAT???

Is this study really stating that the largest single pool of job seekers are people making over $100,000? but yet at the same time this same group of job seekers didn’t even finish college? Come on!

So, if I read this 2012 Social Job Seeker Survey correctly,

85% of the American Workforce has a Facebook account, and of those 85%…

25% of them make over $100,000 per year, and

34% of them have “some college” education.

I’m not sure if this was the best work the polling company has ever done.

What are your thoughts… I’d love to hear them, because I think that recruiters have a much better view of who they are hiring from Facebook, and I’m sure it’s not a bunch of $100K a year, non-college graduates.

Joel Cheesman always has the scoop in the Internet Recruiting industry.

As a subscriber to his blog, I got a late-night email with a tip stating that LinkedIn might be buying Indeed.

That got me thinking… ‚ÄúWhat a brilliant move by LinkedIn!‚Äù

Unfortunately, ‚ÄúThe deal that could have been‚Äù wasn’t.

Instead, Indeed is being acquired by Recruit Co, from Japan. Congratulations to Rony and Paul, the founders of Indeed.com. You guys have done a great job. I’m really happy that you finally got your big payout!

But.. How marvelous would it have been if LinkedIn did actually buy Indeed?

Here are my thoughts… anyone at LinkedIn listening?

In just one acquisition, LinkedIn could have become the world’s largest job board, significantly increased it’s revenue upside, added a significant offerings to employers, put the ‚ÄúLights Out on BranchOut‚Äù, the final nail in the SimplyHired coffin, and the once-and-for-all end of the Monster reign.

How could it have happened?

Here’s my thoughts…

Indeed.com continues to grow as the world’s the largest job board, based on unique website visitors. Indeed has a huge revenue upside, as it just recently released its resume database offering. LinkedIn has pretty much one primary offering for employers… searching it’s profiles. Meanwhile, Indeed has a very successful pay-per-click job posting model that might have been leveraged into a much larger job posting revenue model for LinkedIn. Additionally, Indeed has a large affiliate network of partner sites that drive job seekers to it’s jobs, something that LinkedIn doesn’t have at all.

Indeed’s unique visitor traffic for the month of August 2012 shows nearly 24 million unique visitors, with a 50% year to date user growth rate (as reported by compete.com).

Meanwhile Monster (MWW) shows 18 million uniques monthly visitors with a 24% growth, CareerBuilder 14.4 million uniques with a 10% year-to-year decrease in unique visitors, and SimplyHired flat with 5.5 million uniques and only 2% user growth.

So how does BranchOut fit into the picture?

BranchOut, the ‚ÄúLinkedIn of Facebook‚Äù, has raised over $49 Million in Venture Capital funding, yet their unique user website visitors has declined nearly 80% in 2 months from it’s high of 1.1 million uniques in April. To put those numbers in perspective, BranchOut’s unique visitors show approximately 220,000 unique visitors for 9 of the last 12 months, per Compete.com. On average, that’s less than 1% of Indeed’s current unique visitors. So, while BranchOut is great at getting checks from Venture Capitalists, and news spots from San Francisco based news organizations, they aren’t good at converting and monetizing job seekers.

BranchOut’s primary revenue stream seems to be affiliate job postings from none other than, you guessed it… Indeed!

If LinkedIn had bought Indeed, they might continue the BranchOut / Indeed partnership for a while, or until they decide to put the “Lights Out on BranchOut”. BranchOut’s valuation would go in the crapper because their user visits aren’t sustainable, no matter how much money they throw at the problem, and their only real revenue stream just disappeared.

BranchOut has little, if any, traction with recruiters and employers, so coming up with another revenue stream to monetize a 25 million connected but disinterested users isn’t likely in the short-term.

Additionally, a LinkedIn purchase of Indeed would have given the struggling BranchOut two masters… LinkedIn for it’s revenue and Facebook for its platform.

If that wasn’t bad enough, Facebook is rumored to be launching a job board of it’s own, which by itself, creates an additional huge risk for BranchOut.

Well, how does SimplyHired fit into the picture?

Early on, LinkedIn partnered with SimplyHired to provide ‚Äúback-fill‚Äù job postings on the LinkedIn Job search functionality. It works like this… When a LinkedIn user does a search for jobs, the first results listed are from LinkedIn’s direct clients. Additional listing are ‚Äúback-filled‚Äù from SimplyHired’s database of job postings. While SimplyHired is tight-lipped about its partner traffic generation, my connections tell me that the LinkedIn traffic is ‚Äúsignificant‚Äù.

Earlier this year SimplyHired went through a major layoff, causing concern about it’s long-term viability. Imagine if LinkedIn killed their partnership with SimplyHired, listing the Indeed job postings instead. A major job seeker traffic loss on top of the layoff might have been the final nail in the SimplyHired coffin.

And what about the Monster?

Well, Monster is for sale. Everyone knows it, and no one wants to buy it.

It’s future revenues prospects aren’t great. It doesn’t look like anyone wants to buy a washed up ‚ÄúMonster with no soul‚Äù, a ‚Äútechnology company‚Äù with no technology, or a ‚ÄúWorldwide‚Äù job board where European revenues are going downhill faster than Lindsey Vonn. (Those numbers haven’t even started to hit the earnings reports because of how Monster books sales)

Monster has made no strides to increase it’s value proposition to employers or job seekers, even in the face of competition like LinkedIn. As I mentioned in March 2010, LinkedIn IS the new Monster. I just think this would have completely deflated all the efforts Sal and team are doing to put lipstick on a pig. Don’t get me wrong. Monster is a great website and tool for both employers and job seekers, but let’s be honest… the innovation and soul left when it’s founder Jeff Taylor left in 2005.

I really wish LinkedIn did do the deal. That would have been fun to watch! Instead, we’ll have to wait to see what other marginally exciting news might come out of the HR industry this year.